Math Mystery Solved: What Is a Debt-to-Income Ratio?

BIG Ideas:

- A debt-to-income ratio (DTI) is a calculation that lenders use to determine whether you can qualify for a loan.

- The lower your DTI ratio, the better your chances of getting approved for a loan.

- Paying down existing debt, avoiding new credit, and consolidating higher-interest loans can help you reduce your DTI.

Let’s face it, the world of student loans can be a little confusing at times especially when it comes to understanding the acronyms and terminology that’s often thrown around like FAFSA, PLUS, or APR.

If you apply for a loan, one term you’ll hear a lot about is DTI or debt-to-income ratio. It’s a term you should know for a very important reason – it helps determine whether you’ll qualify for that loan.

Good to know, right?

In addition to your credit score, your DTI ratio is one of the main factors that lenders look at to determine whether or not you’ll be able to afford the monthly payment on the student loan you need. And, the lower it is, the better your chances of getting approved.

Here’s a quick study on DTI and how you can improve yours:

How your DTI is calculated

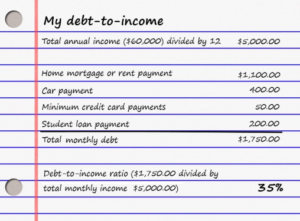

You don’t have to be a Math major to determine your DTI. It’s a pretty simple calculation: it’s your monthly debt payments divided by your average monthly income. Here’s how to go about determining yours:

- Add up all of your annual income and divide by 12.

- Make a list of your monthly debt payments and add them up. You can typically find them by checking your monthly statements from your current lenders. Be sure to use the minimum monthly payment for credit cards, even if you pay extra each month. If you have a credit account that has no monthly minimum payment, lenders may choose to use a percentage (1-3%) of the current or original balance to estimate the monthly payment. Once you’ve collected the monthly debt payments, simply add them up.

- Divide your total debt payments by your monthly income.

Example: After adding up your income and expenses, you determine that your monthly income (your annual income / 12) is $5,000 and your expenses are $1,750 per month. Dividing your expenses by your monthly income will give you your DTI, which in this case is .35 or 35%. Usually, lenders look at your gross monthly income, which is the amount of money you make before taxes are taken out.

What debts and income are included in your DTI?

Now that you know how DTI ratios are calculated, you can get a little more precise with your own numbers. Different lenders may use different debts during their calculations, but most include the following:

- Mortgage or rent payments

- Home insurance payments

- Property tax payments

- Homeowners’ association fees

- Car payments

- Student loan payments

- Child support payments

- Alimony payments

- Minimum credit card payments

- Personal loan payments

Note: Utility bills, groceries, and gas are excluded from your DTI. In some instances, if you’re refinancing another loan, the lender will ignore the monthly payment of the loan being refinanced and calculate your DTI with the monthly payment of the new loan.

As far as income goes, lenders will look at your monthly income before taxes. This can include:

- All wages

- Commissions

- Bonuses

- Self-employment income

- Investment income

- Child Support or alimony

Generally, a lender will take the annual amount of all of your income and divide the number by 12 to arrive at your estimated monthly income.

Ways to lower your debt-to-income ratio

Lowering your DTI can definitely improve your chances of being approved for a student loan. You can accomplish that by increasing your monthly income, though that may not be a realistic option. Or, you can take an easier option, lowering your debt. Here are some ways to accomplish that:

- Pay down credit card debt. Lowering the balance on your credit card will lower the required monthly payment and ultimately improve your DTI ratio.

- Don’t take on new debt. It sounds silly but needs to be said. Avoid large purchases and don’t open new credit accounts. Instead, focus on paying down your debts as much as possible.

- Reconfigure your debt. If you have good credit but want to improve your DTI ratio, reconfiguring your debt can result in a lower monthly debt payment. You can do this by refinancing your home, car, or student loans. You can also extend the term of a loan. If you choose any of these options, you do need to be aware of the consequences. Refinancing often has fees and other costs associated with it and extending the term of the loan will lead to you paying more in interest over the life of the loan.

- Take out a debt consolidation loan. If you have several high-interest credit cards, paying them off and ultimately consolidating that debt under one loan can save you money and lower your monthly debt payments. This option only works well if you’re committed to not running the balances back up on your credit cards.

Like improving your credit score, improving your debt-to-income ratio can take a bit of time, but there are steps you can start taking today that will improve it.

We’re here to help you every step of the way

Need a little help getting the student loan you need? For more than 40 years, Brazos Higher Education has been offering helpful guidance and support to make education possible. As a Texas non-profit, we can offer you BIG savings on a wide range of private loans for students and parents. Contact us today.